Challenges Faced by Nepali Women Entrepreneurs

March 8, 2021

Notorious for being large scale pollutant, affecting wildlife habitat and human population alike, and plastic waste has become a key global concern in recent years. The critical environmental issue has alarmed multitude of stakeholders and has attracted attention of private enterprises.

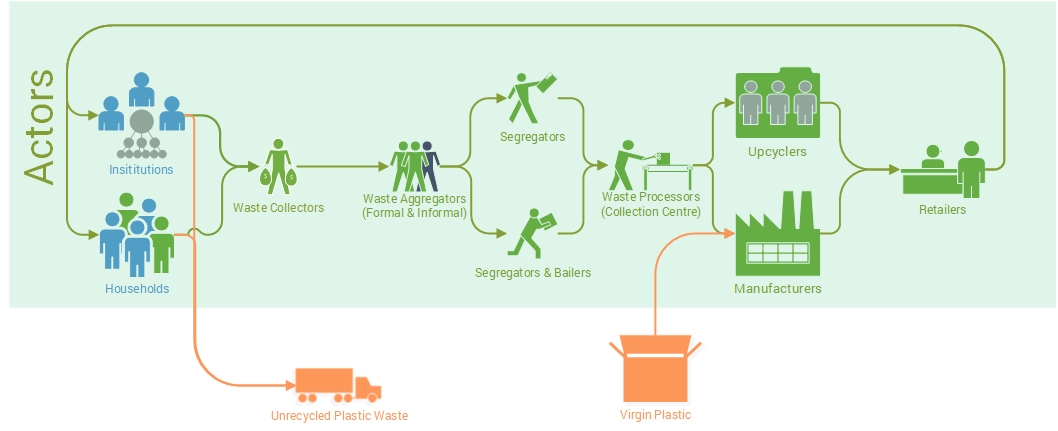

Biruwa Advisors recently conducted a Value Chain Analysis on recycled plastic for World Vision International Nepal. In the study, we assessed the feasibility and sustainability of possible investment opportunities for private companies in the plastic waste management sector of Nepal. Part of this study investigated challenges that exists in the value chain of recycled plastic.

To examine the relevant process in the field of plastic waste management, and to gain better understanding on the subject – we interviewed important actors of industry who are trying to contribute to overall value chain.

Major Challenges of Recycling Plastic Waste

While conducting the research we discovered multiple challenges that exist at different stages of recycled plastic value chain. Some of those challenges are shared below:

1. Lack of Source Segregation Process

It is not a standard practice in Nepal to segregate waste at source. Household wastes are manually segregated after collection and before selling to manufacturers, up cyclers and retailers.

Segregating and storing waste after collection is a major challenge

Considering waste aggregators and waste suppliers have limited space, segregating and storing waste after collection becomes a major challenge. Lack of practices to segregate waste at sources adds a burden of additional processing cost to the businesses as well as the whole sector.

2. Dominance of Informal Sector and Informal Commercial Practices

Much of plastic waste recycling industry is dominated by informal sector. Although, few new actors are trying to formalize existing waste recycling industry by introducing globally recognized best practices, their efforts are being challenged by syndicates of informal sectors.

Efforts to introduce globally recognized practices are challenged by Syndicates of informal sector

While Informal sector also enjoy the advantages of not complying with both trade and waste treatment regulations. Formal enterprises have to take more steps to comply with regulations. For instance, formally established enterprises have to ensure fair treatment of collected waste, and adopt commercial trade practices like maintenance of VAT/Tax records. But, informally established enterprises, are not inclined to comply with such standards and practices. This is not only a Nepali reality but also a regional concern. A Strategic Analysis Report on Emerging Criminal Trends in the Global Plastic Waste Market since 2018, released by INTERPOL in 2020, emphasizes on illegal trade and illegal treatment of plastic wastes in Eastern European as well as South and South-East Asian countries.

3. Negative Social Perception towards Waste Management

Waste Management is a stigmatized area. Value chain actors bear the consequence of negative social perception towards waste management in Nepal. Generally, people lack a sense of ownership over waste that they produce, and the attitude impacts operation of overall waste management industry.

“We are facing difficulty in continuing our work since the land allocated for segregation could not be used due to complaints from the neighborhood.” – An interviewer shared.

For instance, value chain actors find it difficult to acquire land to collect and segregate waste. At the same time, the industry which is labor-intensive faces tremendous challenge in finding adequate supply of skilled labor who can implement professional practices in waste management activities.

4. Competition with Virgin Plastic

Recycled plastics are used as substitutes for virgin plastics. However, it is not as easy for suppliers to sell recycled plastics to manufacturers as parameters like pricing and quality influences the buying decision.

Price and Quality of Recycled Plastic influence Manufacturer’s buying decision

Price of plastic is linked to the price of petroleum. Manufacturers are price sensitive and switch to Virgin plastic when its prices are low.

Secondly, Manufacturers who produce plastic items have to adhere to certain quality standards. As it is difficult to provide the required level of quality in recycled plastic, manufacturers opt out to using virgin plastic to meet the quality standards that their company assures its customers of.

Despite seemingly complicated challenges, the value chain actors including suppliers, manufacturers and enablers have taken significant risk in Nepal. Their shared efforts are not only assisting in introducing globally accepted waste treatment and trading practices in Nepal, but is also starting new trends in the overall plastic waste management sector. We thank all of you for helping us during our study and for your contribution in developing the circular economy in Nepal.